Mistakes happen-especially when it comes to complex accounting tasks. The Common Mistakes in QuickBooks Online Job Costing Use Workyard to quickly pull live reports on how your labor costs are tracking for each of your projects and QuickBooks Online to still get a complete picture of all costs and dig into your vendor and material related expenses. When you use Workyard along with QuickBooks, you’ll get a much more accurate picture of your labor costs costs for each of your projects so you can make better, more informed decisions. In addition to labor-related costs, Workyard also makes it easier to track mileage and travel-and allocate those costs to your expense reports. Rather than booting up QuickBooks, look at your labor reports within the Workyard dashboard. Labor is frequently the highest cost in construction.

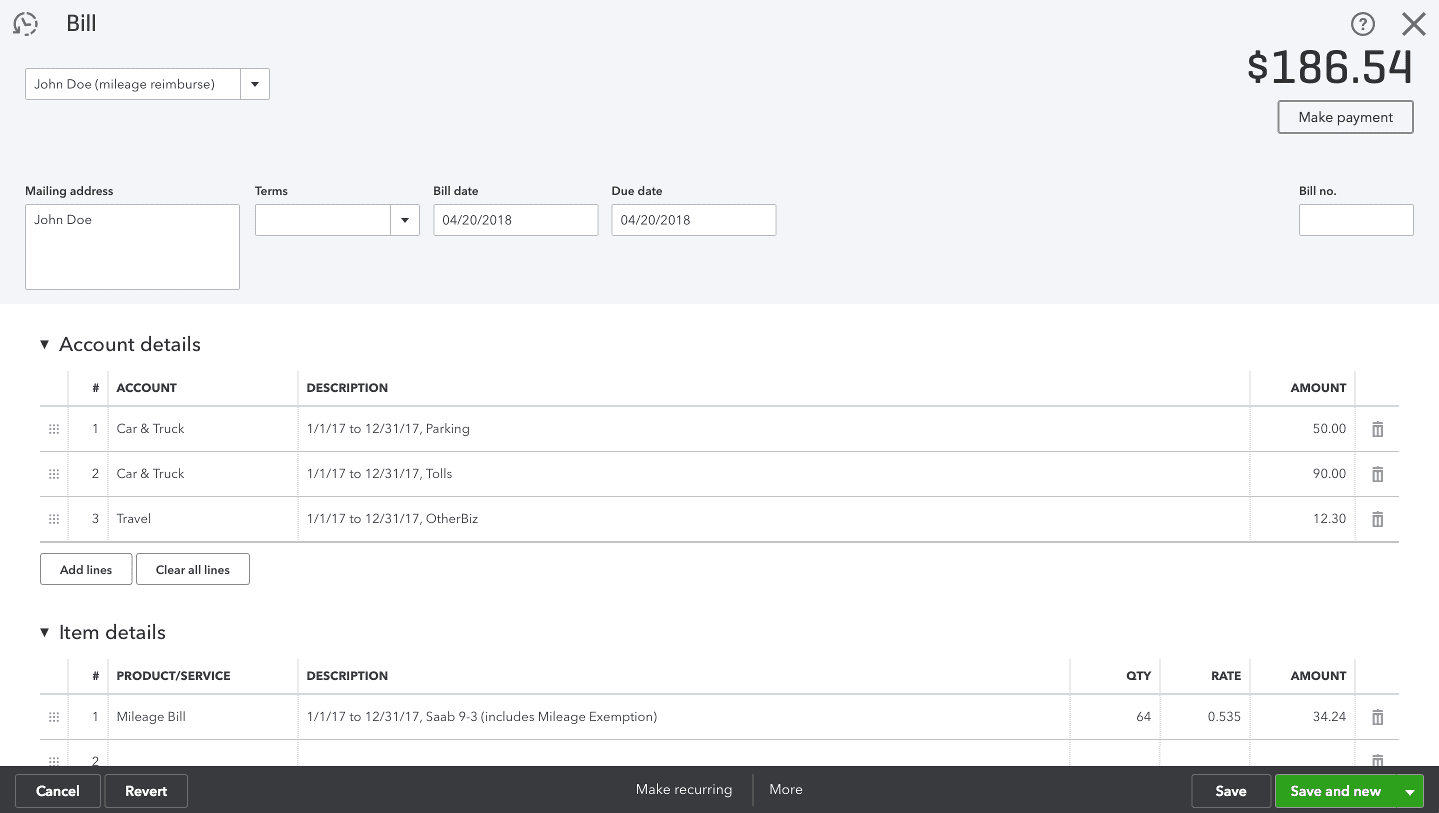

There are different ways to record different types of expenses in QuickBooks. Begin To Assign Your Labor & Material Expenses to Jobs

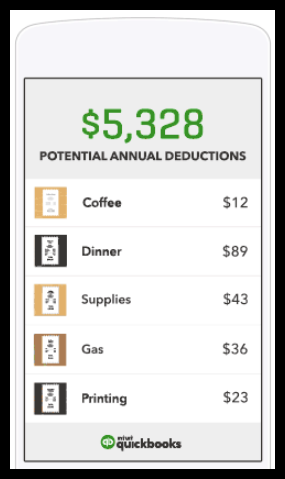

Quickbooks small business track mileage how to#

Here’s a quick video on how to setup projects in QuickBooks:Ģ. Click OK to save the customer and job information.Enter information about the job in the “Job Information” section, such as the job name, start date, and job status.Select the appropriate customer from the list, or create a new one.Click the “New Customer & Job” button at the top of the page.In QuickBooks, go to the “Customers” menu and select the “Customer Center.”.Set Up a “Customer” and a “Job” for Each Jobīefore you pull your job costing reports, you will need to create customers and projects to track. Let’s look at how you can quickly and easily create a job costing report. The three main types of expenses you are going to be booking to jobs: How Do You Create a Job Costing Report in QuickBooks Online?Ĭreating a job costing report requires that you book all your expenses in QuickBooks on a project-by-project basis in other words, you should allocate every project-related expense you book in QuickBooks to a project. Your job costing reports will include a brief overview, transactions assigned to the project, and the time spent working on the project. You can also pull job costing reports after you’ve finished a job to see your profit margin and make tweaks in future bids. You can pull job costing reports while a project is still active to determine where you are relative to your budget.

Job costing reports provide an overview of how much each job has cost so far-so you can determine whether you’re making or losing money on the job. In QuickBooks Online, job costing begins with allocating expenses to specific jobs.

An Overview Of How Job Costing in QuickBooks Online Works

0 kommentar(er)

0 kommentar(er)